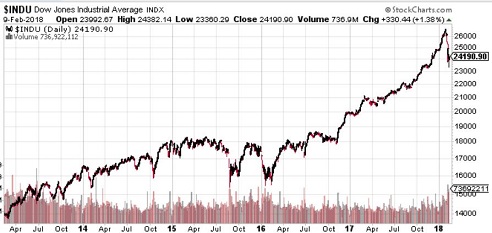

Last week saw the 10-year yield take a breather once more. The big news of the week was the long overdue correction in the stock market. For those that invest in the stock market, it has been a great two-year run. However, whenever we have corrections, investors get spooked. They start wondering if this is going to be a BIG correction. And, candidly, no one knows for sure. This is why diversification is so important.

Diversification often means different things to different advisers. If you are a real estate centric adviser, then often the advice might be to invest in different types of real estate. If you are a typical financial adviser, then you might have a client invest in markets all over the world. You might also suggest a split between bonds and stocks/mutual funds.

So, depending on your advisers and your own experience, you may be more of a real estate investor or a stock market investor. Keeping this simple, that does not seem to be taking full advantage of diversification. I am seeing more and more investors blend both in their portfolios. With that stated, it is difficult for these investors to find unbiased advisers. The reality is that most advisers only get paid when you have a transaction in their field of expertise.

Personally, I have a background in both worlds. My philosophy is to just serve the client’s needs and objectives. My role is to present the various alternatives with the pros and cons. This way my clients see me as an unbiased adviser. It also breeds better relationships and leads to more referrals. For those cynics, this also serves me well in the long run.

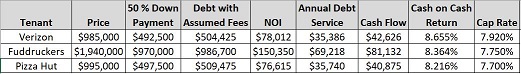

You will notice below that I am presenting once more some properties in the NNN category. My goal here is to educate all on another way to invest in real estate. Many understand it; and many do not. It is a way to invest while minimizing the daily headaches of property management. This should be an area that investors are exposed to.

Investments Opportunities for Purchase with Strong Cash Flow:

Back on the January 15th update, I wrote about “Creating Residential Listings Using Commercial Opportunities.” This week I want to present some of those investment opportunities to better educate all on what is actually available. Note that these are all Single Tenant Net Leased properties that have listed in about the last 10 days. In addition, I assumed a 5% loan with 50% down. This is just a small sample of what is actually available (for a larger version of the list, click here).

If you assume investors in the Bay Area are getting a cash flow of 3.5%, then you can see the potential improvement with these properties above. This approach is great for the investors desiring increased cash flow, an opportunity to get out of daily property management, and/or taking the challenges of rent control off the table. Should you wish to discuss any of these or others, then give me a call.

That’s it for this week. As always, feel free to give me a call with any of your strategic financing needs.

Articles of Interest:

The SJ Mercury News reported “Bay Area rents likely to stay sky high.”

The Wall Street Journal reported “Banks double down on branch cutbacks in fastest decline on record.” This will open up some nice properties to new tenants.

The SJ Mercury News also reported “San Jose ballot measure would force real estate developers to hire local.”

See the table below for approximate interest rates.

| Type | Rate | Fixed Term |

| Apartments | 4.280% – 4.985% | 3 to 10 year (30 yr amortization) |

| Commercial | 4.600% – 5.285% | 3 to 10 year (25 yr amortization) |

| SBA | Call | Call |