What can I expect from Marty Lefton, Commercial Broker, and SV Commercial Lending?

We are at the initial stage of deciding if we want to work together.

If there is one thing that you should know about our working together on your lending needs, it is that I strive hard to work as your advocate. Whether you are a large national bank looking to help one of your clients, a seasoned commercial real estate investor, or a first-time business owner trying to decide whether or not to purchase a building for your new company, it is my job to look out for your interests.

In many ways, my job is to protect clients from what they do not know. In a commercial real estate transaction, it can be devastating trying to “learn from your mistakes”. My goal with my clients is to minimize the wasted time and financial burden that comes from a lack of knowledge.

Now candidly, having great support and advocates protecting you does not really matter until something goes wrong. It is at that moment where expertise, experience and troubleshooting can save a client significant dollars and major stress and headaches. And the culminating benefit of the vast experience that I do have, is to keep you and your lending solution from going wrong in the first place.

When I am just starting to work with someone, this is the best time to deal with whatever concerns and issues that may exist. Although a large part of my business comes from referral; there are always a few lingering questions in the minds of prospective clients.

Questions and Answers:

Below I have jotted down what seem to be the standard concerns so that you may digest them when it is convenient. I suspect you may have other questions/concerns as well; and please feel free to call me to discuss those whenever you wish.

Why would I want to employ a Commercial Mortgage Broker?

A strong, well-seasoned commercial mortgage broker is there to support your objectives, caution you where and when pitfalls exist, be an objective resource, and look to placing your loan needs with the optimal lending source. Sometimes that is not the lowest rate with the best terms. The reason for that last comment stems from experience. Some institutions have reputations for getting loans done on time and at the terms as initially discussed. Others historically can be difficult and surprises often occur. The cost of surprises can range from a few thousand dollars to hundreds of thousands depending on the situation. It is best to find an advocate that treats your money like it is their own. And it is critical to understand the terms being presented by the lenders. There is a lot of jargon in the business that needs to be interpreted (terms, prepayment implications, etc.).

Okay, I see the value of having an advocate. Why should I choose Marty Lefton?

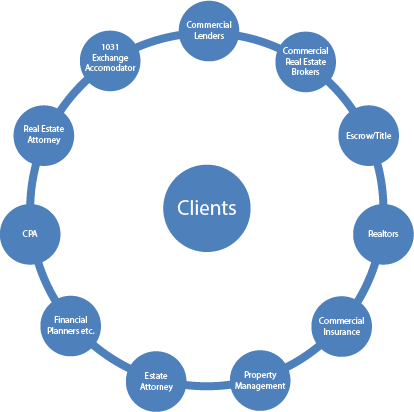

This is where you need to know who you are working with because someone cannot recommend the right program for you if they do not fully understand and evaluate your situation. I have 35 years of business experience. It ranges from IT, Insurance, Financial Advising, Speculative Building to ultimately becoming a Commercial Loan Broker. It is my nature to be a detail person and a troubleshooter. It is my job to take all the chaos; and then calm the process to ensure a timely completion of your loan. I look for areas of concern in any situation so I can avoid unnecessary headaches and costs. With my background, I protect my clients in many ways as I am usually aware of the impact of another professional (see diagram) in a commercial real estate transaction. When I spot these concerns, I make my clients aware so we can avoid a potential crisis. In many ways, my job is to protect clients from what they do not know. A lot of us learn from our mistakes. My goal with my clients is to minimize the costs due to a lack of knowledge.

I also have a strong database of professionals who share my belief in doing what is in the best interests of a client. As a team, we are there to again protect your interests. As simple as this may sound, doing what is right for the client is the best marketing any professional can do. It allows all of us to develop relationships (versus a one-time transaction). These relationships provide a safe way to discuss concerns and provide an atmosphere towards developing a long-term investment strategy. Doing the right thing minimizes the concern of buyer- beware.

My clients use me as a resource when looking to restructure and optimize their real estate loan portfolio based on their changing objectives (cash flow vs. appreciation vs. a combination).

Next steps:

- Discuss any concerns

- Decide if we want to work together (and it is okay for either of us to say no)

- My expectations:

- When we work together, I will make several requests of you via email. It is important to your timeline to have you respond to the requests in a timely fashion. Please provide exactly what is being requested of you. Assuming the lender will take anything other than what is requested will cause delays.

- Communicate all potential issues in the front end. If you are hoping the lender won’t discover the issue, then you may be risking a loss of your deposits at the very least.

- Communicate any concerns you have when you have them. I want to make sure the process is as stress-free as possible.

- Upon completion of your transaction, I will look to you to help others understand the value I provide to my clients. Your referrals to other strong clients requiring this approach is helpful to me and can greatly support others in obtaining their own wealth-building goals.

- Again, use me as your advocate and to provide resources as needed.